In this article, you will learn strategies to help you manage and navigate through the challenges of Forex market volatility. The Forex market is known for its unpredictability and fluctuations, and it is important to have a plan in place to cope with these changes. You will discover ways to effectively analyze market trends, develop a risk management strategy, and stay informed about global economic events. These content strategies will equip you with the tools and knowledge necessary to navigate the Forex market with confidence during turbulent times.

Strategies for Coping with Forex Market Volatility

Volatility in the Forex market is a common occurrence that can create both opportunities and challenges for traders. It refers to the fluctuations and rapid price movements that currencies experience due to various factors such as economic and political news, market sentiment, and changes in interest rates. While volatility can offer potential profits, it can also lead to significant losses if not properly managed.

To effectively cope with Forex market volatility, it is essential to develop a trading plan, implement risk management strategies, adapt to market conditions, utilize hedging techniques, maintain emotional discipline, adopt long-term strategies, utilize automated trading systems, and seek professional guidance when needed. By following these strategies, you can better navigate the turbulent waters of the Forex market and increase your chances of success.

This image is property of www.morebusiness.com.

Understanding Forex Market Volatility

Before diving into strategies for coping with Forex market volatility, it is important to have a clear understanding of what exactly volatility means in the context of trading currencies. Volatility refers to the rate and magnitude of price changes in a currency pair. It is often measured using indicators such as the Average True Range (ATR) and the Volatility Index (VIX). High volatility indicates large price swings, while low volatility suggests stability in the market.

Causes of Forex Market Volatility

There are several factors that can contribute to Forex market volatility. Economic news releases, such as monetary policy announcements, GDP reports, and employment data, can have a significant impact on currency prices. Political events, such as elections and geopolitical tensions, can also cause volatility as they influence market sentiment and investor confidence. Additionally, changes in interest rates and market expectations can trigger large price movements.

This image is property of www.usbank.com.

Impacts of Forex Market Volatility

The impacts of Forex market volatility can be both positive and negative. On one hand, higher volatility can present lucrative trading opportunities, allowing traders to profit from rapid price movements. However, volatility can also increase the risk of losses, as prices can move against a trader’s position quickly. Therefore, it is crucial to implement effective strategies to cope with market volatility and mitigate potential risks.

Developing a Trading Plan

To navigate Forex market volatility successfully, it is essential to develop a comprehensive trading plan. This plan should outline clear goals and objectives, guiding your trading decisions and actions. Setting realistic targets for profit and risk tolerance can help you stay focused and disciplined during volatile market conditions.

This image is property of creative-currency.org.

Performing Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, news releases, and geopolitical events to understand the underlying factors that drive currency prices. By keeping track of economic calendars and staying updated with important news, you can anticipate volatility and make informed trading decisions.

Implementing Technical Analysis

Technical analysis involves the use of price charts, indicators, and patterns to predict future price movements and identify potential trading opportunities. By analyzing historical price data, you can identify trends, support and resistance levels, and breakout patterns that can help you navigate market volatility.

This image is property of framerusercontent.com.

Risk Management Strategies

One of the most critical aspects of coping with Forex market volatility is implementing effective risk management strategies. Setting stop loss and take profit levels for each trade can limit potential losses while allowing for profit-taking. Determining the appropriate position size based on your risk appetite can also help you manage volatility. Diversifying your Forex portfolio by trading multiple currency pairs can further reduce the impact of volatility on your overall trading performance.

Adapting to Market Conditions

In volatile market conditions, it is crucial to adapt your trading strategies accordingly. Identifying trends and breakout patterns can help you capitalize on price movements. Utilizing volatility indicators, such as Bollinger Bands or the Average True Range, can provide insights into market conditions and potential trading opportunities. Staying updated with economic news releases and their impact on currency pairs can also help you make better-informed trading decisions.

This image is property of titanfx.imgix.net.

Implementing Hedging Techniques

Hedging is a risk management strategy that involves opening opposite positions in correlated currency pairs or using options and futures contracts to offset potential losses. By hedging your positions, you can protect your portfolio from adverse market movements and reduce your exposure to volatility. Understanding the concept of hedging, utilizing currency correlations, and exploring options and futures contracts can be valuable tools in coping with Forex market volatility.

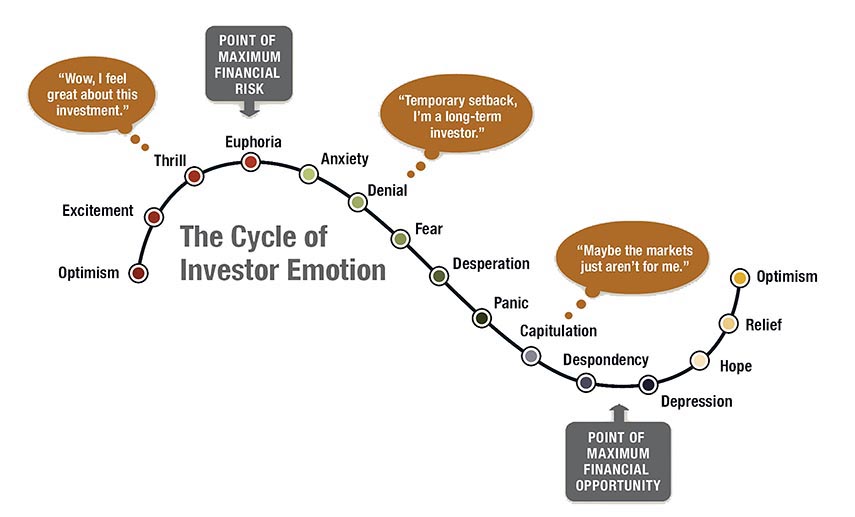

Maintaining Emotional Discipline

In volatile market conditions, emotions can run high, leading to impulsive trading decisions based on fear or greed. To cope with Forex market volatility, it is crucial to maintain emotional discipline. Controlling fear and greed, avoiding impulsive trading decisions, and sticking to your trading plan can help you make rational decisions based on market analysis instead of emotional reactions. Utilizing demo accounts for practice can also help you build emotional discipline by simulating real market conditions without the risk of losing real money.

Adopting Long-Term Strategies

While short-term trading can be enticing in volatile market conditions, adopting long-term trading strategies can provide stability and resilience. Position trading, which involves holding trades for weeks or months, allows you to ride larger trends and minimize the impact of short-term volatility. Swing trading, which focuses on capturing shorter-term price swings, can also be effective in volatile markets. Additionally, carry trading, which involves taking advantage of interest rate differentials, can provide consistent profits over time.

Utilizing Automated Trading Systems

Automated trading systems, commonly known as Forex robots or expert advisors, can help cope with Forex market volatility by implementing predefined trading strategies without human intervention. These systems can operate 24/7, continuously analyzing market conditions and executing trades based on pre-established rules. The benefits of using automated trading systems include removing emotional biases, backtesting and optimization to improve performance, and saving time by automating trading tasks. To choose a reliable Forex robot, thorough research and testing are recommended.

Seeking Professional Guidance

For novice traders or those looking to enhance their skills, seeking professional guidance can be beneficial. Hiring a Forex mentor who has experience and expertise in navigating volatile markets can provide valuable insights and guidance. Joining trading communities or forums can also provide a platform for exchanging ideas and discussing strategies with like-minded individuals. Attending Forex workshops and seminars can further enhance your knowledge and skills and keep you updated with the latest developments in the Forex market.

Conclusion

Coping with Forex market volatility requires a combination of strategies and constant adaptation to changing market conditions. By developing a trading plan, implementing risk management strategies, adapting to market conditions, utilizing hedging techniques, maintaining emotional discipline, adopting long-term strategies, utilizing automated trading systems, and seeking professional guidance, you can increase your chances of success in the Forex market. Continual learning and improvement are essential in navigating the dynamic and unpredictable nature of market volatility.