In this article, we will discuss some valuable tips to help you avoid falling victim to Forex scams and frauds. You will learn about the different types of scams that exist in the Forex market and how to identify them. We will also provide practical advice on how to protect yourself from these scams, including conducting thorough research, verifying the credibility of brokers, and being cautious of promises that sound too good to be true. By the end of this article, you will have a better understanding of the red flags to look out for and be better equipped to navigate the Forex market safely.

Tips to Avoid Forex Scams and Frauds

As online trading becomes increasingly popular, so does the risk of falling victim to Forex scams and frauds. The foreign exchange market, or Forex, attracts millions of traders worldwide, making it an attractive target for scammers looking to exploit the unsuspecting. However, by following some key tips and being aware of red flags and warning signs, individuals can protect themselves from falling prey to these fraudulent schemes.

Understanding the different types of Forex scams

Forex scams can take various forms, each with the intention of deceiving traders and stealing their money. One common type is the “signal seller” scam, where individuals or companies claim to have insider knowledge or foolproof trading strategies that can guarantee high profits. These scammers often charge exorbitant fees for their services, only to provide ineffective or misleading information.

Another prevalent scam is the manipulation of trading software or platforms. Some fraudsters offer fake trading software that promises extraordinary returns, but in reality, it is designed to manipulate trades and cause losses. Additionally, there are Ponzi schemes and pyramid schemes masquerading as legitimate Forex investment opportunities, promising unrealistic returns and encouraging individuals to recruit more participants.

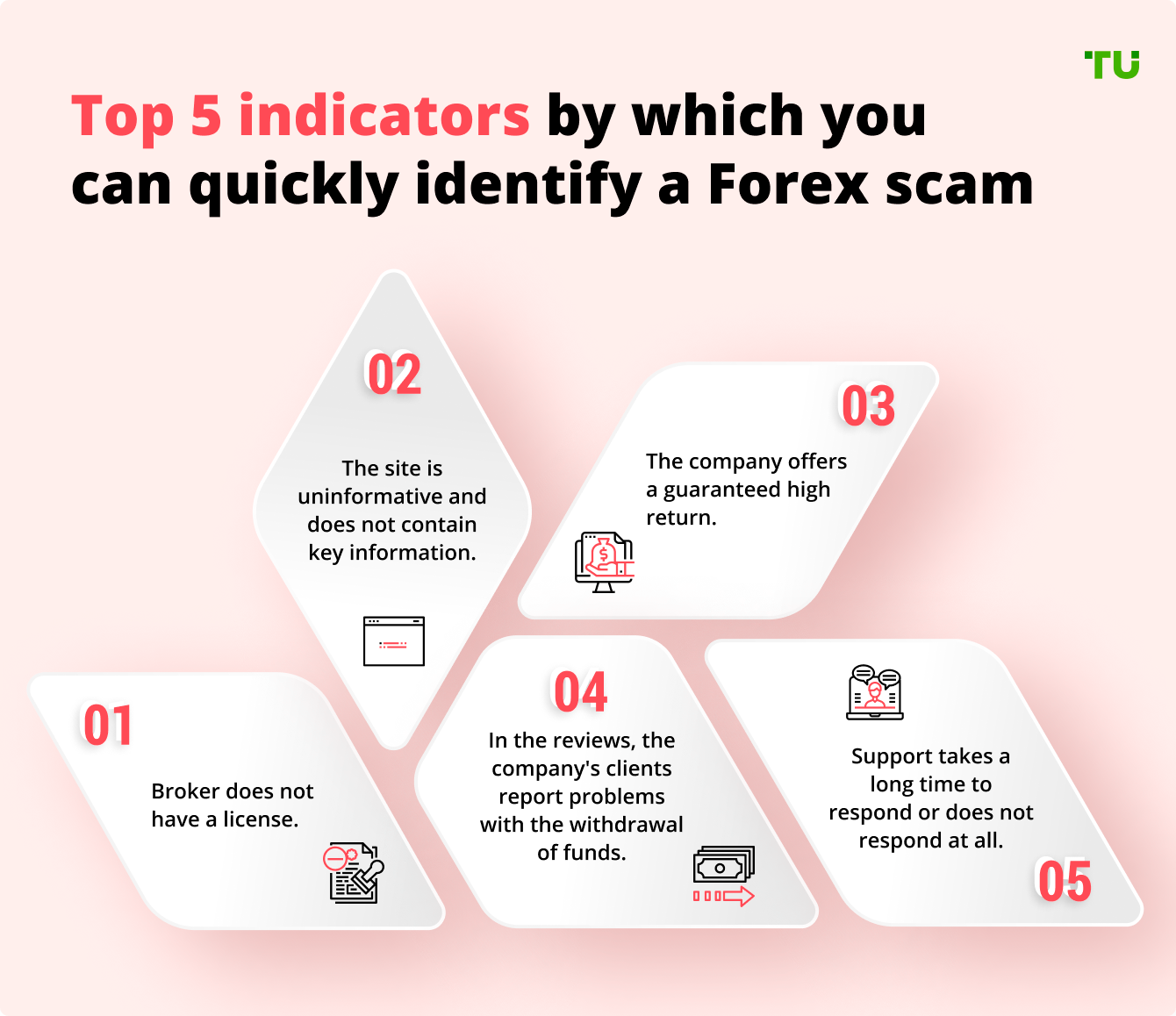

Recognizing red flags and warning signs

Being able to identify red flags and warning signs is crucial in avoiding Forex scams and frauds. Common red flags include promises of guaranteed high profits with little or no risk, unsolicited investment offers through phone calls or emails, and high-pressure tactics to make quick investment decisions. Scammers often use aggressive marketing techniques to play on individuals’ fear of missing out on lucrative opportunities.

Other warning signs include unregulated or offshore brokers operating from jurisdictions known for their lack of financial regulations, inconsistencies in a broker’s track record, and unprofessional websites or customer service. If something seems too good to be true or raises suspicions, it is essential to conduct thorough research and exercise caution before investing any money.

Choosing a Reliable Forex Broker

To safeguard your investment and avoid falling victim to Forex scams, it is crucial to choose a reliable and reputable Forex broker. Here are some steps to consider when selecting a broker:

Researching the broker’s reputation and track record

Before depositing your funds with a Forex broker, it is vital to research their reputation and track record in the industry. Look for reviews from other traders and check if the broker has any history of scams or fraudulent practices. Consider using independent platforms that provide unbiased reviews and ratings of Forex brokers.

Checking for regulatory compliance

Regulatory compliance is essential in ensuring the broker operates within legal boundaries and adheres to industry standards. Check if the broker is registered with reputable regulatory authorities, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom. Regulated brokers are more likely to follow ethical practices and offer a higher level of protection for traders’ funds.

Evaluating the broker’s trading platform and services

Take the time to evaluate the broker’s trading platform, as it will be the interface through which you execute trades and manage your investments. Ensure the platform is user-friendly and offers essential features such as real-time market data, technical analysis tools, and risk management options. Additionally, review the broker’s customer service and support capabilities to ensure they are readily available to address any concerns or issues.

This image is property of tradersunion.com.

Protecting Personal and Financial Information

To avoid being a victim of identity theft or financial fraud, it is crucial to protect your personal and financial information when engaging in online Forex trading. Here are some tips to keep in mind:

Using secure internet connections and devices

When accessing your trading account or providing personal information, ensure that you are using a secure internet connection. Avoid using public Wi-Fi networks, as they are often unsecured and vulnerable to hacking attempts. Additionally, make sure your computer or mobile device has proper security measures in place, such as antivirus software and a firewall.

Being cautious about sharing personal information

Be cautious about sharing personal information with brokers, especially when it comes to sensitive details such as your Social Security number or bank account information. Legitimate brokers will only require necessary information to verify your identity and comply with regulatory guidelines. If a broker requests unnecessary or excessive personal information, it could be a warning sign of a potential scam.

Employing strong passwords and two-factor authentication

Choose strong and unique passwords for your trading accounts, combining uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable passwords and never share them with anyone. Additionally, enable two-factor authentication whenever possible, as it adds an extra layer of security by requiring a second verification method, such as a unique code sent to your mobile device.

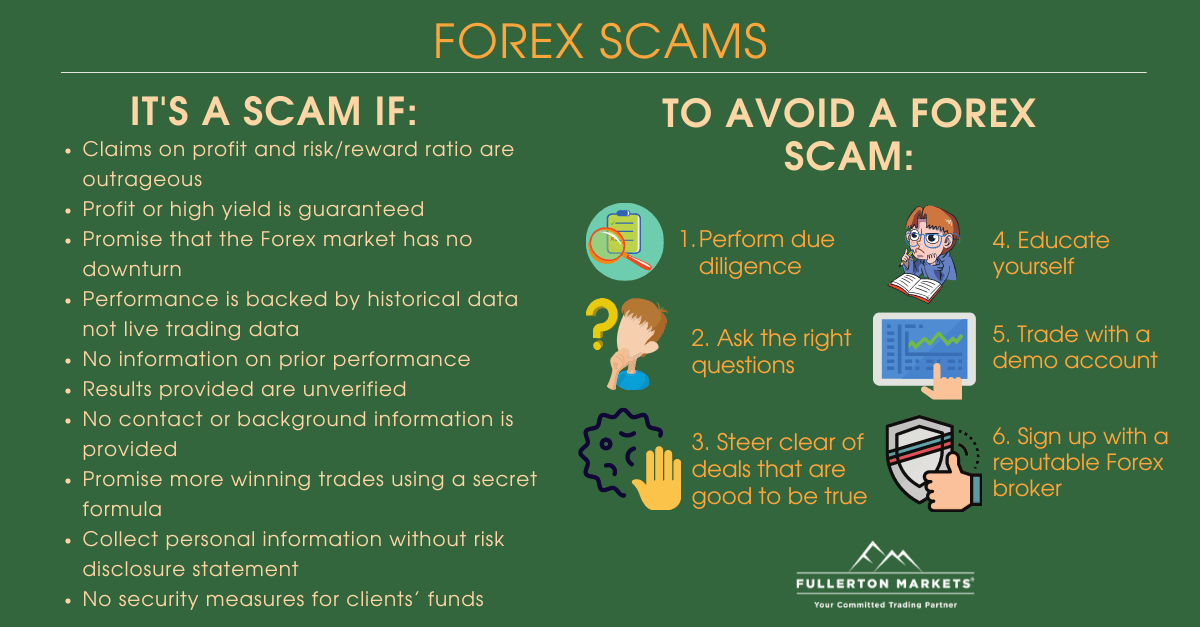

Avoiding Unrealistic Promises and Get-Rich-Quick Schemes

One essential aspect of avoiding Forex scams is to recognize that trading carries inherent risks and uncertainties. While successful Forex trading can be profitable, it requires knowledge, experience, and discipline. Here are some tips to avoid falling for unrealistic promises and get-rich-quick schemes:

Understanding that Forex trading involves risks and uncertainties

Forex trading involves the buying and selling of currencies in an attempt to profit from fluctuations in exchange rates. However, it is essential to understand that no trading strategy can guarantee constant profits or eliminate the possibility of losses. Take the time to educate yourself on risk management techniques and have realistic expectations about the potential returns and risks involved in Forex trading.

Being cautious of guaranteed high profits

Scammers often lure unsuspecting individuals with the promise of guaranteed high profits in a short period. They may claim to have secret insider information or proprietary trading algorithms that can generate substantial returns. However, it is important to remember that no legitimate trader or system can predict the market with complete accuracy. Avoid brokers or investment programs that offer unrealistic profit claims or exaggerate their success rates.

Avoiding pyramid or Ponzi schemes

Pyramid schemes and Ponzi schemes are fraudulent investment schemes that rely on recruiting new participants to pay returns to existing investors. They often promise high returns on investments without engaging in any legitimate trading activities. Be wary of any investment opportunity that relies heavily on recruitment or promises profits solely through referring others. Legitimate Forex brokers and investment opportunities make money through trading activities, not through recruiting new members.

This image is property of vladimirribakov.com.

Educating Yourself on Forex Trading

To navigate the Forex market safely and make informed trading decisions, it is essential to educate yourself on the fundamentals of Forex trading. Here are some steps to enhance your knowledge and understanding:

Learning the basics of Forex trading

Start by learning the basic concepts of Forex trading, including currency pairs, pips, and leverage. Familiarize yourself with fundamental and technical analysis techniques to interpret market trends and patterns. There are numerous online resources and educational platforms that provide free or paid courses on Forex trading, offering valuable insights for beginners and experienced traders alike.

Keeping yourself updated with market news and trends

Stay informed about the latest news and events that can impact the Forex market. Economic indicators, geopolitical developments, and central bank decisions can significantly influence currency valuations. Follow reputable financial news sources and subscribe to market analysis newsletters to receive regular updates on market trends. Being well-informed will help you make more informed trading decisions and avoid being caught off-guard by sudden market movements.

Acquiring knowledge from reliable sources and educational resources

Avoid relying solely on self-proclaimed Forex gurus or internet forums that may provide misleading or inaccurate information. Seek knowledge from credible sources, such as established financial institutions, reputable Forex brokers, and industry experts. Academic books, online courses, and webinars conducted by trusted professionals can provide valuable insights and guidance to develop your trading skills.

Performing Due Diligence on Investment Opportunities

Before investing your hard-earned money, it is crucial to conduct thorough due diligence to ensure the legitimacy and credibility of the investment opportunity. Consider the following steps:

Investigating the legitimacy of investment opportunities

Research and investigate any investment opportunity thoroughly before committing your funds. Look for verifiable evidence of a company’s existence, trading history, and performance track record. Beware of investments that promise unrealistically high returns or lack transparency in providing information about their operations. Utilize online forums and review websites to gather insights and opinions from other clients or investors.

Verifying the credentials and background of investment companies

Check the credentials and background of any investment company or fund manager before entrusting them with your money. Verify their licensing, certifications, and memberships in professional bodies or associations. Reputable investment companies will provide transparent information about their team members’ qualifications, experience, and expertise in the financial industry.

Consulting with trusted financial professionals

Seek advice from trusted financial professionals, such as financial advisors, accountants, or lawyers, before making any investment decisions. They can provide valuable insights and help you evaluate the risks and potential returns of different investment opportunities. A professional review can help uncover potential scams or fraudulent practices that may not be apparent to individuals without financial expertise.

This image is property of www.fullertonmarkets.com.

Staying Away from Unregulated or Offshore Brokers

One of the most critical steps in avoiding Forex scams is to stay away from unregulated or offshore brokers. Here’s why:

Understanding the risks associated with unregulated brokers

Unregulated brokers operate without any oversight or regulation from reputable financial authorities. This lack of oversight exposes traders to the risk of fraudulent practices, unfair trading conditions, and potential loss of funds. Unregulated brokers do not have to adhere to strict financial controls and may engage in unethical behaviors that could harm traders.

Checking for proper licensing and regulation

Before depositing your money with a Forex broker, ensure that they are licensed and regulated by reputable financial authorities. Regulatory bodies, such as the SEC, FCA, or Australian Securities and Investments Commission (ASIC), enforce strict regulations to protect traders’ interests and maintain the integrity of the financial markets. Proper licensing provides you with a level of confidence that the broker operates within established guidelines and undergoes regular audits.

Avoiding brokers located in known offshore scam jurisdictions

Some countries and offshore jurisdictions have gained a reputation for being safe havens for fraudulent brokers. They often have lax financial regulations and offer easy licensing processes for Forex brokers. Avoid brokers located in such jurisdictions, as they tend to attract scammers and lack the necessary safeguards to protect traders’ funds. Stick to brokers regulated by reputable financial authorities in countries with robust financial oversight.

Being Skeptical of Unsolicited Investment Offers

Unsolicited investment offers, whether through phone calls or emails, are often a red flag for potential scams. Here are some precautions to take:

Avoiding unsolicited phone calls or emails offering investment opportunities

Be cautious about unsolicited phone calls or emails from individuals or companies offering investment opportunities. Legitimate investment opportunities are typically not marketed through aggressive sales calls or mass email campaigns. Treat such offers with skepticism and subject them to thorough scrutiny before considering any investment.

Verifying the authenticity and credibility of investment offers

If you receive an unsolicited investment offer, take the time to verify the authenticity and credibility of the offering party. Research the company or individual making the offer, check their website, reviews, and background. Legitimate investment opportunities will have a transparent and well-documented track record, and professional companies will have a robust online presence.

Consulting with trusted financial advisors before making any decisions

When in doubt, always consult with trusted financial advisors or professionals before making any investment decisions. They can help you assess the legitimacy of the investment offer, analyze the risks and potential returns, and guide you towards making informed choices. Avoid rushing into investment decisions based solely on unsolicited offers or promises of quick profits.

This image is property of tradersunion.com.

Seeking Legal and Regulatory Assistance in Case of Fraud

Despite taking all precautions, it is still possible to fall victim to Forex scams or fraudulent practices. In such cases, seeking legal and regulatory assistance can help in rectifying the situation. Here’s what you need to know:

Knowing the legal framework and regulations related to Forex fraud

Familiarize yourself with the legal framework and regulations governing Forex trading and fraud in your jurisdiction. Understand your rights as a trader and the obligations of brokers and investment companies. This knowledge will empower you to take appropriate action in case of fraud and enable you to effectively communicate with regulatory authorities or legal professionals.

Contacting regulatory authorities to report fraudulent activities

If you believe you have been a victim of Forex fraud, report the incident to the relevant regulatory authorities in your country. They have the expertise and authority to investigate and take appropriate action against fraudulent brokers or investment schemes. Prompt reporting of fraudulent activities is crucial to protect other potential victims and ensure the enforcement of legal measures.

Seeking legal assistance for resolving financial disputes

In cases where financial disputes arise from fraudulent activities or scams, seeking legal assistance may be necessary to recover lost funds or seek compensation. Consult with competent legal professionals who specialize in financial fraud cases to understand your options and pursue appropriate legal actions. A legal professional can guide you through the complex legal process and advocate for your rights.

Conclusion

Protecting oneself from Forex scams and frauds requires a combination of due diligence, education, and skepticism. By following the tips outlined in this article, individuals can minimize their exposure to fraudulent practices and avoid financial losses. Remember to research and choose reliable Forex brokers, protect personal and financial information, avoid unrealistic promises and get-rich-quick schemes, educate yourself on Forex trading, perform due diligence on investment opportunities, stay away from unregulated or offshore brokers, be skeptical of unsolicited investment offers, and seek legal and regulatory assistance if necessary. By being proactive and vigilant, individuals can navigate the Forex market with confidence and reduce the risk of falling victim to scams and frauds.