In this article, you will learn about the carry trade strategy in the Forex market. The carry trade is a popular trading strategy where investors borrow low-interest currencies to invest in high-interest currencies, aiming to profit from the interest rate differential. We will explore how the carry trade works, its potential risks and rewards, and considerations when implementing this strategy. By the end of this article, you will have a thorough understanding of the carry trade strategy and its application in Forex trading.

Understanding the Carry Trade Strategy in Forex

When it comes to the world of trading in the foreign exchange (Forex) market, there are various strategies that traders employ to make profits. One such strategy is the carry trade. In this article, we will dive into the intricate details of the carry trade strategy, explaining its core concept and how it can be implemented effectively to maximize your gains.

:max_bytes(150000):strip_icc()/dotdash_final_Currency_Carry_Trades_101_Dec_2020-01-159e176451ab46fe9eb2917525127277.jpg)

This image is property of www.investopedia.com.

Defining the Carry Trade

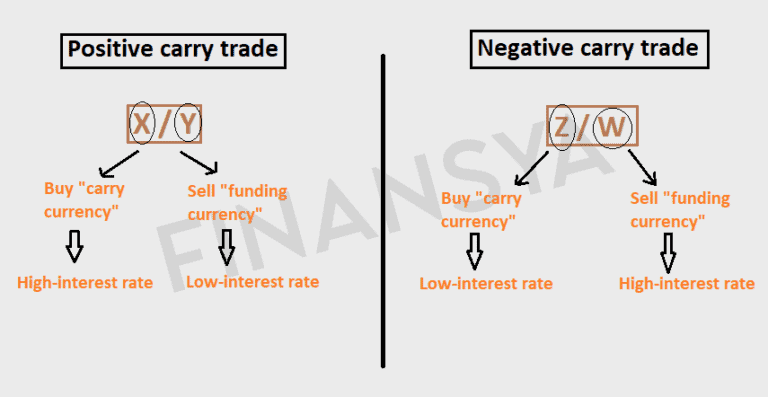

The carry trade is a forex trading strategy that involves profiting from the interest rate differential between two currencies. In simple terms, it is about borrowing money in a currency with a low interest rate and using the funds to invest in a currency with a higher interest rate. Traders who utilize this strategy aim to profit from the interest rate gap while taking advantage of potential currency appreciation.

The essence of the strategy lies in the disparity between interest rates in different countries or economic regions. Central banks and monetary authorities around the world adjust interest rates to control inflation and stimulate economic growth. As a result, interest rates fluctuate, creating opportunities for traders to capitalize on these disparities.

How it Works

Let’s say you are a trader based in the United States and decide to employ the carry trade strategy. You begin by borrowing in a currency with a low interest rate, such as the Japanese Yen (JPY). You then convert the borrowed funds into another currency that offers a higher interest rate, such as the Australian Dollar (AUD).

By doing this, you have essentially “sold” the JPY and “bought” the AUD. Since the interest rate in Australia is higher than that in Japan, you can earn interest on the amount you converted into Australian Dollars. This interest is known as the “carry” and is paid daily or monthly, depending on the terms set by the broker.

However, in order to make profits with the carry trade, it’s not enough to simply receive interest on your invested funds. You also need to consider the exchange rate fluctuations between the two currencies.

This image is property of a.c-dn.net.

Exchange Rate Risk

While the carry trade strategy may seem like a surefire way to make profits, it is important to note that it comes with its fair share of risks. One significant risk is the potential for exchange rate fluctuations.

Due to the constantly changing nature of the forex market, exchange rates can fluctuate dramatically. If the exchange rate between the JPY and AUD were to move against you, any profits made from the interest rate differential could be wiped out or even turn into losses. Therefore, it is crucial to carefully analyze the potential exchange rate movements and consider risk management strategies when implementing the carry trade.

Evaluating Carry Trades

Before entering into a carry trade, it is essential to analyze a variety of factors that could affect its success. Firstly, you need to determine the interest rate differentials between the two currencies involved. This information can be obtained from central bank announcements or economic websites.

Secondly, assessing the economic stability of both countries involved is vital. Stable economies tend to have currencies that are less volatile, reducing the risk of sudden currency depreciation that could negatively impact the carry trade strategy.

Furthermore, understanding the overall market sentiment and the potential impact of geopolitical events is crucial. Any unexpected news or events can cause significant fluctuations in exchange rates, so staying informed and keeping an eye on the market is imperative.

This image is property of finansya.com.

Sensitivity to Interest Rate Shifts

As with any investment strategy, the carry trade has its own set of risks and challenges. One key factor to consider is the sensitivity of the strategy to interest rate shifts.

When there are unexpected shifts in interest rates, it can lead to a rapid change in the demand and supply of currencies. This sudden shift can cause substantial movements in exchange rates, affecting the profitability and stability of the carry trade.

As a trader utilizing the carry trade strategy, you must stay updated on the interest rate decisions of central banks and be prepared for potential shifts. The ability to predict and react to these changes is crucial to successfully executing the strategy.

Risk Management

To mitigate the risks associated with the carry trade strategy, proper risk management techniques must be applied. Here are a few strategies to consider:

- Diversification: Spreading your investments across multiple currency pairs can help balance risks and minimize potential losses. By diversifying your investments, you’re not solely reliant on one currency pair, reducing the impact of adverse movements in a single pair.

- Stop-loss orders: Placing stop-loss orders can limit your potential losses in case the trade moves against you. A stop-loss order is an instruction to your broker to automatically close the trade if the exchange rate reaches a specific level, preventing further losses.

- Take-profit orders: Similar to stop-loss orders, take-profit orders are instructions to close the trade when the exchange rate reaches a predefined level of profit. This allows you to secure your gains and exit the trade at a favorable level.

By employing these risk management techniques, you can minimize potential losses and protect your investments when using the carry trade strategy.

This image is property of www.ifcmarkets.com.

Conclusion

The carry trade strategy in Forex offers the potential for significant profits by capitalizing on interest rate differentials. It involves borrowing in a low-interest-rate currency and investing in a higher-interest-rate currency. However, it is crucial to carefully assess the risks associated with exchange rate fluctuations and implement effective risk management techniques.

As with any investment strategy, thorough research, analysis, and awareness of market conditions are essential when implementing the carry trade strategy. By understanding the intricacies of the strategy and being mindful of potential risks, you can increase your chances of success in the Forex market.