In this article, you will explore the benefits of automated Forex trading. You will learn how it can save you time and effort by executing trades on your behalf, based on a set of predetermined rules. Additionally, you will discover how automated trading can help remove emotions from the trading process, leading to more consistent and disciplined trading decisions. Furthermore, we will discuss the potential for increased execution speed and accuracy that automated trading offers. By the end of this article, you will have a comprehensive understanding of the advantages of automated Forex trading.

Exploring the Benefits of Automated Forex Trading

Forex trading is a highly dynamic and fast-paced industry, requiring traders to make split-second decisions based on intricate market analysis. To keep up with the ever-changing market conditions and leverage profitable opportunities, many traders are turning to automated Forex trading. This innovative approach to trading offers numerous benefits that can significantly enhance your chances of success. In this article, we will explore the advantages of automated Forex trading and why it has become increasingly popular among traders worldwide.

This image is property of i1.wp.com.

Increased Efficiency of Trading

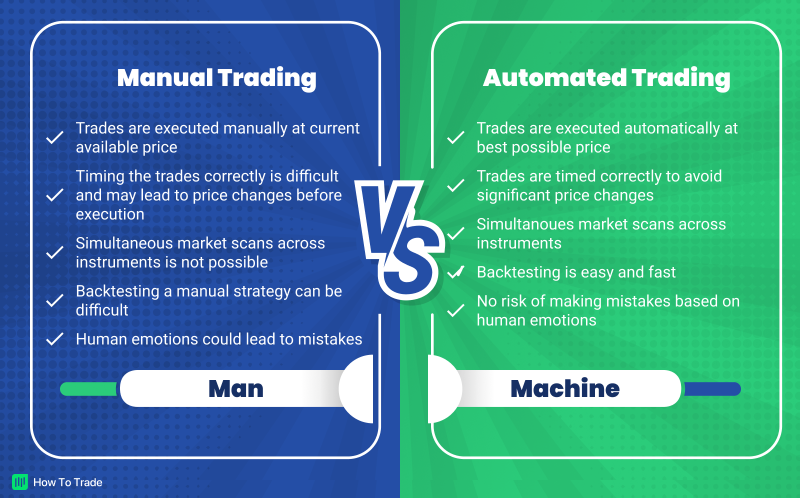

One of the primary benefits of automated Forex trading is increased efficiency. With automated systems, trades are executed automatically based on predefined parameters and algorithms. This eliminates the need for manual intervention, allowing trades to be executed swiftly and efficiently. By removing the human element from the trading process, you can avoid delays caused by emotions, distractions, or human error. Automated trading systems can execute trades within milliseconds, ensuring that you don’t miss out on profitable opportunities.

24/7 Trading Availability

Another significant advantage of automated Forex trading is the ability to trade 24/7. The Forex market operates around the clock, five days a week. This means that it is virtually impossible for a human trader to monitor the market constantly. However, automated systems can trade tirelessly, even when you’re asleep or away from your trading desk. They can react to changing market conditions and execute trades instantly, providing you with the advantage of 24/7 trading availability.

This image is property of www.forex.academy.

Reduced Emotional Bias

Human emotions, such as fear and greed, often interfere with logical decision-making in the Forex market. Emotion-driven trades can lead to impulsive and irrational decisions, which can result in significant losses. Automated Forex trading eliminates the influence of emotions, as trades are executed based on pre-defined rules and algorithms. By removing emotional bias from the equation, automated systems can make rational and objective trading decisions, leading to more consistent and disciplined trading results.

Ability to Backtest Strategies

One of the key advantages of automated trading systems is the ability to backtest strategies. Backtesting refers to the process of testing a trading strategy using historical market data to determine its profitability. Manual backtesting can be a time-consuming and laborious task. However, automated Forex trading systems can backtest multiple strategies quickly and accurately. By analyzing past market data, you can evaluate the performance of different strategies and refine or optimize them accordingly. This allows you to have a better understanding of the viability and profitability of your trading strategies before risking real capital.

This image is property of howtotrade.com.

Immediate Trade Execution

In the fast-paced world of Forex trading, timing is crucial. Delayed trade execution can cost you profitable opportunities. Automated Forex trading systems can execute trades immediately as soon as the predefined conditions are met. This ensures that you enter or exit trades at the most favorable price levels, maximizing your potential profits. With immediate trade execution, you can take advantage of short-term price fluctuations and swiftly react to market movements.

Diversification of Trading Opportunities

Automated Forex trading systems enable you to diversify your trading opportunities. By using automated systems, you can simultaneously trade multiple currency pairs, timeframes, and strategies. This diversification reduces the risk associated with relying on a single trading approach or market condition. Additionally, automated systems can identify and execute trades across different markets and asset classes, such as stocks, commodities, and cryptocurrencies. This allows you to tap into a wide range of opportunities and potentially increase your overall profitability.

This image is property of www.forex.academy.

Ability to Trade Multiple Markets Simultaneously

Automated Forex trading systems not only enable you to diversify your trading opportunities but also allow you to trade multiple markets simultaneously. With manual trading, it can be challenging to monitor multiple markets effectively. However, automated systems can analyze and monitor multiple markets simultaneously, identifying trade opportunities in real-time. This increases your exposure to different markets and enhances your chances of capitalizing on profitable trades across various instruments.

Minimized Human Error

Even the most experienced traders are prone to human error. Fatigue, lack of concentration, or simple oversight can lead to costly mistakes. Automated Forex trading systems eliminate the risk of human error by executing trades based on predefined rules and algorithms. These systems operate based on objective parameters, ensuring consistency and accuracy in trade execution. By minimizing human error, automated trading increases the overall reliability and precision of your trading strategies.

This image is property of www.forex.academy.

Real-time Monitoring and Alerts

Automated Forex trading systems offer real-time monitoring and alerts, providing you with immediate insights into market conditions and trade opportunities. These systems continuously analyze market data, monitor price movements, and assess technical indicators. When a trading opportunity arises or a predefined condition is met, the system can generate real-time alerts or notifications. This ensures that you are always informed about potential trade setups and can take prompt action. Real-time monitoring and alerts enable you to stay on top of the market and make timely trading decisions.

Conclusion

Automated Forex trading offers numerous benefits that can significantly enhance your trading experience and profitability. From increased efficiency and 24/7 trading availability to reduced emotional bias and the ability to backtest strategies, automated systems provide a competitive edge in the fast-paced Forex market. By leveraging the power of automation, you can trade multiple markets simultaneously, minimize human error, and capitalize on diverse trading opportunities. So, consider exploring the world of automated Forex trading and unlock its potential to take your trading to new heights.