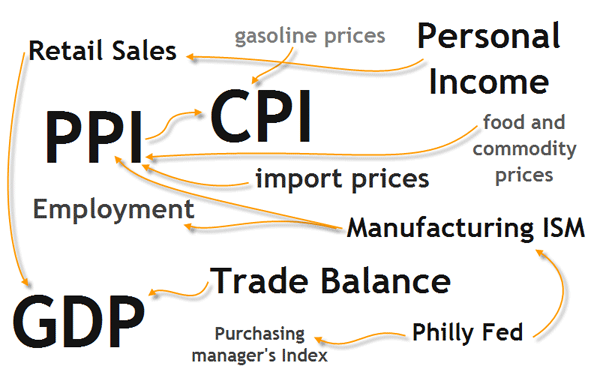

In this article, we will explore the impact of economic indicators on Forex markets. You will gain an understanding of how these indicators, such as GDP, interest rates, and employment data, can influence currency values and market trends. We will discuss the relationship between economic indicators and Forex trading, highlighting the importance of staying informed on global economic news. By the end of this article, you will have a clearer insight into how economic indicators can significantly impact the Forex market and potentially guide your trading decisions.

This image is property of learningcenter.fxstreet.com.

Introduction

In the world of Forex trading, understanding the impact of economic indicators is essential for success. Economic indicators provide valuable information about the state of a country’s economy, and they play a crucial role in determining the value of currencies in the Forex market. By analyzing these indicators, traders can make informed decisions and capitalize on potential opportunities. This article will explore the different types of economic indicators, their significance in Forex markets, and how they can be interpreted and utilized in trading.

What are economic indicators?

Economic indicators are statistical data points that provide insights into the overall health and performance of an economy. These indicators are typically released by government agencies, central banks, and other relevant organizations on a regular basis. They offer a snapshot of key elements such as GDP (Gross Domestic Product)GDP (Gross Domestic Product), inflation, employment, and interest rates, among others. By analyzing these indicators, traders can gauge the strength or weakness of a country’s economy and make predictions about the direction of its currency.

Importance of economic indicators in Forex markets

Economic indicators play a fundamental role in Forex markets as they provide traders with crucial information about the underlying factors that drive currency values. By tracking and analyzing these indicators, traders can identify trends, predict market movements, and make informed decisions about buying or selling currencies. Economic indicators offer insights into the overall health of an economy, which directly impacts the supply and demand dynamics of its currency. As a result, staying informed about economic indicators is critical for successful Forex trading.

Types of Economic Indicators

There are three main types of economic indicators: leading indicators, lagging indicators, and coincident indicators. Each type provides different insights into the state of an economy and can have varying impacts on Forex markets.

Leading indicators

Leading indicators are economic factors that change ahead of the overall economy. These indicators are used to predict future trends and often provide early signals of potential changes in economic activity. Examples of leading indicators include stock market performance, housing starts, and consumer confidence. In Forex trading, leading indicators can help traders anticipate market movements and make timely decisions that align with the changing economic landscape.

Lagging indicators

Lagging indicators, on the other hand, are economic factors that change after the overall economy has already begun shifting. These indicators confirm trends that have already occurred and provide historical data rather than future predictions. Examples of lagging indicators include unemployment rates, interest rates, and the Consumer Price Index (CPI). While lagging indicators may not offer immediate predictive insights, they still hold value as they provide a retrospective analysis of economic conditions.

Coincident indicators

Coincident indicators are economic factors that change simultaneously with the overall economy. These indicators reflect the current state of the economy and provide real-time insights into its performance. Coincident indicators include GDP, industrial production, and retail sales. In Forex trading, coincident indicators are useful for assessing the current health of an economy and determining the potential impact on currency values.

Key Economic Indicators

Several key economic indicators have a significant impact on Forex markets. Understanding the implications of these indicators is crucial for Forex traders looking to make informed decisions.

Gross Domestic Product (GDP)

Gross Domestic Product, or GDP, is one of the most important economic indicators. It measures the total value of all goods and services produced within a country’s borders during a specific period. GDP is a comprehensive measure of economic activity and provides insights into the overall health and growth of an economy. In Forex markets, positive GDP growth is generally associated with currency appreciation, as it indicates a robust economy with higher demand for its currency.

Consumer Price Index (CPI)

The Consumer Price Index, or CPI, measures the average price change of a basket of goods and services over time. It is used to monitor inflation and purchasing power. When the CPI increases, it suggests rising inflation and a decrease in the currency’s purchasing power. In Forex markets, an increase in CPI typically leads to currency devaluation as it erodes the value of the currency over time.

Employment data

Employment data, including the unemployment rate and non-farm payroll data, provides valuable insights into the labor market. Low unemployment rates are generally associated with currency strength, as they indicate a healthy job market and strong economic growth. Conversely, high unemployment rates are often associated with currency weakness, as they suggest a struggling economy and diminished demand for its currency.

Interest rates

Interest rates have a significant impact on currency values. Central banks adjust interest rates to manage inflation and stimulate or slow down economic growth. Rising interest rates typically lead to currency appreciation, as higher rates attract foreign investors seeking higher returns. Conversely, a cut in interest rates can lead to currency depreciation, as lower rates make the currency less attractive to investors looking for higher yields.

Impact of GDP on Forex markets

The GDP of a country has a direct impact on Forex markets. Positive GDP growth is generally associated with currency appreciation, while negative GDP growth tends to result in currency depreciation.

Positive GDP growth and currency appreciation

When a country’s GDP grows positively, it reflects a robust and expanding economy. This, in turn, increases the demand for the country’s goods and services, leading to higher demand for its currency. Forex traders often interpret positive GDP growth as a sign of economic strength and may buy the currency in anticipation of its appreciation.

Negative GDP growth and currency depreciation

Negative GDP growth indicates an economic contraction and a decline in economic activity. This decrease in economic output often leads to decreased demand for a country’s goods and services, resulting in a decline in its currency value. Forex traders may sell the currency in anticipation of further depreciation, resulting in a negative impact on Forex markets.

:max_bytes(150000):strip_icc()/economic_indicator.aspfinal-15940724deaf40e09bf27f9e6b0bf832.jpg)

This image is property of www.investopedia.com.

Impact of CPI on Forex markets

The Consumer Price Index, or CPI, is a vital economic indicator that has a direct impact on Forex markets. Changes in CPI can influence currency values in different ways.

Increase in CPI and currency devaluation

When the CPI increases, it suggests rising inflation and a decrease in the currency’s purchasing power. As a result, Forex traders may anticipate a decline in the value of the currency and sell it accordingly. This increase in supply can lead to currency devaluation, negatively affecting Forex markets.

Decrease in CPI and currency appreciation

Conversely, a decrease in CPI indicates falling inflation and an increase in the currency’s purchasing power. Forex traders often interpret this as a positive sign and may buy the currency in anticipation of its appreciation. This increase in demand can lead to currency appreciation, positively impacting Forex markets.

Impact of Employment Data on Forex markets

Employment data, including the unemployment rate and non-farm payroll data, can significantly influence Forex markets. Changes in employment levels provide insights into the overall health of an economy and impact currency values.

Low unemployment rate and currency strength

A low unemployment rate suggests a healthy job market and strong economic growth. Forex traders often interpret this as a positive sign and expect increased consumer spending and economic activity. As a result, the demand for the currency of a country with a low unemployment rate tends to increase, leading to currency strength in Forex markets.

High unemployment rate and currency weakness

Conversely, a high unemployment rate indicates a struggling economy and diminished confidence in its currency. Forex traders may interpret this as a negative sign and expect reduced consumer spending and economic activity. As a result, the currency of a country with a high unemployment rate may weaken in Forex markets.

This image is property of fxmedia.s3.amazonaws.com.

Impact of Interest Rates on Forex markets

Interest rates play a crucial role in Forex markets as they impact currency values. Changes in interest rates can influence foreign investment and affect the demand for a country’s currency.

Rise in interest rates and currency appreciation

When a country’s central bank raises interest rates, it signals confidence in the economy and aims to manage inflation. Higher interest rates attract foreign investors seeking higher returns, leading to increased demand for the currency. This increased demand often results in currency appreciation in Forex markets.

Cut in interest rates and currency depreciation

A cut in interest rates, on the other hand, suggests a central bank’s efforts to stimulate economic growth or manage deflationary pressures. Lower interest rates make the currency less attractive to foreign investors, resulting in decreased demand. This decreased demand often leads to currency depreciation in Forex markets.

Interpreting Economic Indicators in Forex Trading

Interpreting economic indicators is a vital skill for Forex traders, as it enables them to make informed decisions and capitalize on trading opportunities.

Analyzing the impact of economic indicators

To effectively analyze the impact of economic indicators, Forex traders need to examine the relationship between the indicator and the currency in question. For example, a positive GDP growth rate may have a different impact on one currency compared to another. By understanding the underlying factors and their influence on currency values, traders can make more accurate predictions and tailor their trading strategies accordingly.

Using economic indicators to make trading decisions

Economic indicators can serve as valuable tools for making trading decisions. By monitoring and analyzing these indicators, Forex traders can identify opportunities to buy or sell currencies based on anticipated market movements. For example, a trader may decide to sell a currency if they expect negative GDP growth or an increase in CPI. Conversely, they may choose to buy a currency in response to positive employment data or a rise in interest rates. Utilizing economic indicators in this manner helps traders align their strategies with the prevailing economic conditions.

This image is property of blackwellglobal.com.

Economic Calendar and Forex Trading

To stay informed about economic indicators and their potential impact on Forex markets, traders often refer to an economic calendar.

Understanding the economic calendar

An economic calendar is a tool that provides a schedule of economic releases, including key economic indicators. It helps traders plan their trading activities and stay updated on upcoming events that may influence currency values. The economic calendar typically includes information such as the release date and time, the indicator being released, and the predicted and actual values. By consulting the economic calendar, traders can stay ahead of market-moving events and adjust their strategies accordingly.

Utilizing the economic calendar in Forex trading

Traders can utilize the economic calendar to identify potential trading opportunities and manage risk. By analyzing the economic releases and their expected impact, traders can plan their trades in advance. For example, if a highly anticipated CPI release suggests an increase, a trader may prepare to sell the currency or adjust their stop-loss levels accordingly. As a result, the economic calendar serves as a valuable resource for Forex traders looking to make informed decisions based on upcoming economic indicators.

Conclusion

Understanding the link between economic indicators and Forex markets is crucial for successful trading. Economic indicators provide valuable insights into an economy’s health and performance, which directly impact currency values. By tracking and analyzing key indicators such as GDP, CPI, employment data, and interest rates, traders can anticipate market movements and make informed decisions. Utilizing the economic calendar and staying updated on upcoming releases further enhances trading strategies. By incorporating economic indicators into their analysis, Forex traders can navigate the ever-changing Forex markets and increase their chances of success.