In this article, you will learn the basics of Forex trading and discover how to get started with a small investment. We will explore the benefits and risks of Forex trading, as well as the key factors to consider when choosing a broker. Additionally, we will discuss the different types of trading strategies and provide some tips for success in the Forex market. By the end of this article, you will have a solid understanding of how to begin Forex trading with a small investment.

:max_bytes(150000):strip_icc()/day-trading-tips-for-beginners-on-getting-started-4047240_FINAL-e9aa119145324592addceb3298e8007c.png)

This image is property of www.thebalancemoney.com.

Understanding Forex Trading

Forex trading, also known as foreign exchange trading or currency trading, is the practice of buying and selling currencies on the global market. It is the largest and most liquid financial market in the world, with daily trading volumes reaching trillions of dollars. The forex market operates 24 hours a day, five days a week, allowing traders from around the world to participate at their convenience.

What is Forex trading?

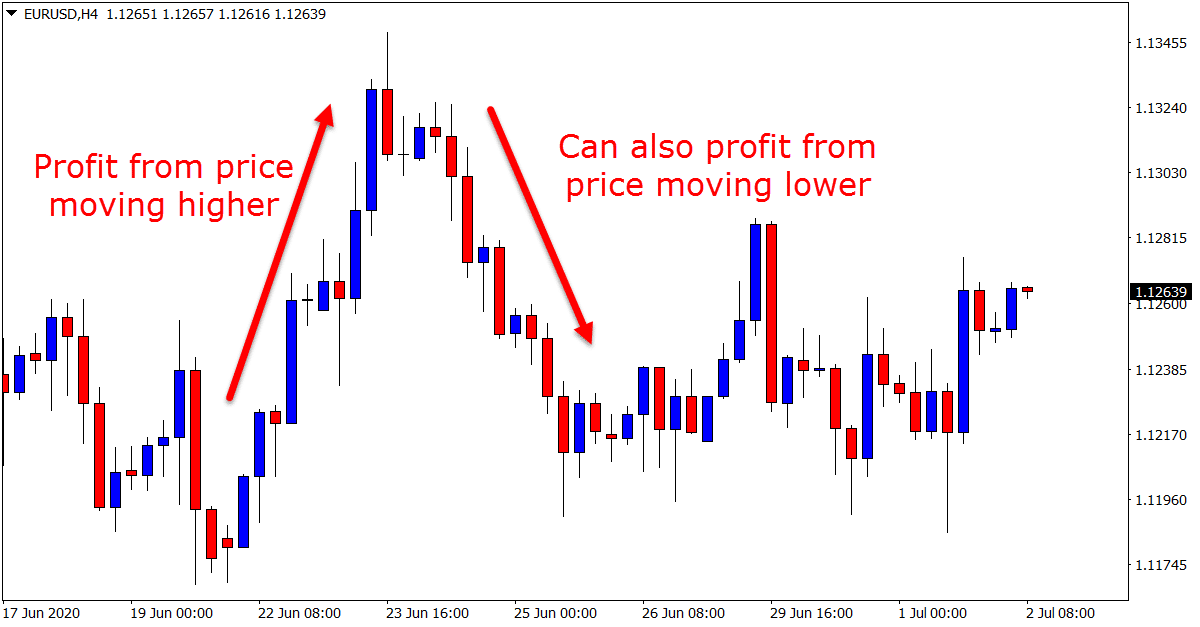

Forex trading involves buying one currency and simultaneously selling another. Currencies are traded in pairs, such as EUR/USD (euro/dollar) or GBP/JPY (pound/yen). The objective is to profit from the fluctuations in exchange rates between the two currencies.

Why is Forex trading popular?

Forex trading has gained popularity among individual investors for several reasons. First, the market is highly accessible, allowing anyone with an internet connection and a small investment to participate. Additionally, forex trading offers the potential for significant profits due to the leverage available. Leverage allows traders to control larger positions with a small amount of capital. Lastly, the forex market is highly liquid, meaning that traders can easily enter and exit trades without significant price fluctuations.

How does Forex trading work?

Forex trading involves speculation on the direction of exchange rates. Traders analyze various factors, such as economic indicators, political events, and market sentiment, to anticipate the movements of currency pairs. They then execute trades based on their analysis, aiming to profit from the price fluctuations.

Benefits of Forex Trading

Liquidity and market hours

The forex market is the most liquid financial market in the world, providing traders with ample opportunities to enter and exit positions at their desired prices. Unlike other markets, such as stocks or commodities, where liquidity can be limited, the forex market is open 24 hours a day, five days a week. This allows traders to react quickly to market news and take advantage of price movements.

Leverage and margin trading

One of the key advantages of forex trading is the availability of leverage. Leverage allows traders to trade larger positions than their account balance. For example, with a leverage ratio of 1:100, you can control a position worth $10,000 with a margin requirement of $100. While leverage can amplify profits, it’s important to remember that it can also increase losses. It is crucial to use leverage responsibly and manage the risks involved.

Profit potential and risk management

Forex trading offers the potential for significant profits, especially when combined with effective risk management strategies. Traders can profit from both rising and falling markets, allowing them to adapt to changing market conditions. However, it’s essential to have a clear understanding of risk management techniques, such as setting stop-loss orders to limit potential losses and using proper position sizing to control risk.

Choosing a Forex Broker

To start forex trading, you’ll need to find a reputable forex broker. Here are some factors to consider when choosing a broker:

Researching reputable brokers

It’s important to choose a broker that is regulated by financial authorities to ensure the safety of your funds. Research different brokers and read reviews from other traders to find a reputable and trustworthy broker.

Comparing spreads and fees

Forex brokers earn money through spreads, which are the differences between the buying and selling prices of currency pairs. Lower spreads mean lower transaction costs for traders. Additionally, consider any additional fees that the broker may charge, such as withdrawal fees or account maintenance fees.

Considering trading platforms and tools

Trading platforms provide the interface for executing trades and accessing market data. Look for a broker that offers a user-friendly and intuitive trading platform, along with advanced charting and technical analysis tools. Some brokers also offer educational resources and market research to help you make informed trading decisions.

Creating a Forex Trading Plan

Before diving into forex trading, it’s crucial to create a trading plan. A trading plan outlines your goals, risk tolerance, and trading strategy. Here are some key aspects to consider when creating your trading plan:

Setting clear trading goals

Define your financial goals and objectives. Are you looking to generate a second income or achieve long-term wealth? Setting clear and realistic goals will help guide your trading decisions and keep you focused on your objectives.

Determining risk tolerance

Every trader’s risk tolerance is different. Assess how much capital you are willing to risk per trade and set guidelines for yourself to protect against excessive losses. This will help you maintain emotional discipline and prevent impulsive trading decisions.

Developing a trading strategy

A trading strategy outlines the rules and methodologies you will follow in your trading. It should include entry and exit criteria, risk management techniques, and indicators or patterns you will use to identify trade opportunities. Backtest your strategy to ensure its effectiveness before implementing it in live trading.

This image is property of www.tradingwithrayner.com.

Opening a Forex Trading Account

To start trading forex, you’ll need to open a trading account with a forex broker. Here are the steps involved:

Checking account requirements

Each broker may have different requirements for opening an account. Typically, you’ll need to provide identification documents, such as a passport or driver’s license, and proof of address, such as a utility bill or bank statement.

Verification process

Brokers are required to verify the identity of their clients as part of regulatory requirements. This process usually involves submitting the necessary documents and completing a Know Your Customer (KYC) procedure.

Funding your trading account

Once your account is verified, you can fund it with the desired amount of capital. Most brokers offer various payment methods, such as bank transfers, credit cards, or e-wallets. Choose the method that is most convenient for you and ensure that the funds are properly credited to your trading account.

Learning Forex Trading Basics

To become a successful forex trader, it’s important to have a solid understanding of the basics. Here are some key concepts you should learn:

Understanding currency pairs

Currency pairs are quoted in terms of one currency relative to another. The first currency in the pair is called the base currency, while the second currency is the quote currency. For example, in the EUR/USD pair, the euro is the base currency, and the US dollar is the quote currency.

Reading Forex charts

Forex charts display price movements over time and are essential tools for technical analysis. Learn to interpret different types of charts, such as line charts, bar charts, and candlestick charts. Familiarize yourself with common chart patterns and indicators, such as moving averages and relative strength index (RSI).

Analyzing market trends

Understanding market trends is crucial for successful trading. Learn to identify uptrends, downtrends, and sideways trends. Additionally, stay updated with economic news releases and their potential impact on the market, as these can provide trading opportunities.

Implementing a Small Investment Strategy

Starting with a small investment requires careful planning and risk management. Here are some strategies to consider:

Choosing the right lot size

Lot size refers to the size of the position you take in the market. When starting with a small investment, it’s advisable to trade micro lots or mini lots, which are smaller position sizes. This reduces the risk per trade and allows you to trade with a smaller account balance.

Managing leverage effectively

While leverage can amplify profits, it can also amplify losses. When starting with a small investment, it’s important to use leverage cautiously and consider lower leverage ratios. This will help you manage the risk and avoid significant drawdowns.

Using stop-loss orders and take-profit levels

Stop-loss orders are orders placed to automatically close a trade at a specific price level to limit potential losses. Take-profit levels are orders used to close a trade at a predetermined price level to lock in profits. Using these orders can help you manage risk and protect your capital.

Practicing with Demo Accounts

Demo accounts are a valuable tool for novice traders to practice trading without risking real money. Here’s how you can make the most of demo accounts:

Utilizing demo trading platforms

Most brokers offer demo trading platforms that simulate real-market conditions. Use these platforms to get familiar with the trading interface and practice executing trades.

Testing trading strategies

Demo accounts allow you to test different trading strategies and evaluate their effectiveness. Try out various techniques and assess their results before implementing them in live trading.

Gaining experience without risking real money

Demo accounts provide a risk-free environment for gaining experience and confidence in your trading abilities. Use this opportunity to learn from your mistakes and refine your trading skills.

This image is property of www.forexschoolonline.com.

Continuous Learning and Improvement

Forex trading is a dynamic and evolving market. To stay ahead, it’s crucial to continuously learn and improve your trading skills. Here are some avenues for ongoing education:

Staying updated with market news and analysis

Stay informed about market news, economic indicators, and geopolitical events that can impact currency prices. Read financial news articles, follow reputable sources, and stay updated with market analysis.

Attending Forex webinars and seminars

Many brokers and industry experts organize webinars and seminars to educate traders. Participate in these events to learn from experienced traders and industry professionals.

Reviewing and fine-tuning trading performance

Regularly review your trading performance and analyze your trades. Identify strengths and weaknesses in your strategy and make adjustments accordingly. Keep a trading journal to track your progress and learn from past trades.

Conclusion

Forex trading with a small investment can be a viable opportunity for individuals to enter the financial markets. By understanding the basics, choosing a reputable broker, creating a trading plan, and practicing with demo accounts, you can start your forex trading journey. Focus on continuous learning and improvement, manage your risks effectively, and maintain emotional discipline to increase your chances of success. Remember, forex trading requires patience, dedication, and a long-term perspective.